Your Guide to Business Resilience Planning

A business resilience plan isn’t just a document you create and file away. It’s about building a company that can genuinely adapt, recover, and grow through whatever gets thrown at it. This isn’t about simply surviving a crisis; it’s about creating a fundamentally stronger, more flexible organization from the ground up.

Why Business Resilience Is Your New Superpower

Let’s be real—running a small business can feel like walking through a minefield some days. One minute it’s a critical supply chain delay, the next it’s a server crash, or maybe a star employee hands in their notice. Surprises are part of the game. That’s exactly where resilience planning makes a difference. It’s not about being paranoid, but about being prepared enough to handle the unexpected with confidence.

I like to think of it this way: business continuity is about fixing the building after an earthquake. Business resilience is about designing a building that can withstand the tremors in the first place. One is reactive, the other is proactive.

From Survival Mode to Strategic Advantage

For a small business, being resilient isn’t just a safety net; it’s a massive competitive advantage.

Picture this: a major supplier in your industry suddenly goes under. The businesses that weren’t prepared are now in a full-blown panic, scrambling to find a replacement. But the resilient business? You’ve already identified and vetted alternative suppliers. You pivot, and the disruption to your customers is minimal, if they even notice it at all.

This kind of readiness transforms a potential disaster into a golden opportunity to grab market share. While your competitors are stuck in chaos, you’re the one still delivering, still serving customers, and reinforcing your reputation for being reliable.

I’ve always told clients: “A resilient organization doesn’t just bounce back from a hit, it bounces forward. It absorbs the shock and adapts to the new reality, often emerging stronger.”

This shift in thinking is everything. It takes planning from a dusty “what-if” binder on a shelf to an active, strategic part of how you run your company every day.

The Growing Need for Resilience

If it feels like the world is getting more unpredictable, you’re not wrong. From global politics to cyber threats, the risks are piling up, making solid planning more critical than ever.

Don’t just take my word for it. A recent report from security professionals found that a staggering 76% of businesses feel that risks are increasing. That’s an 8% jump in just one year, driven by everything from natural disasters and cyberattacks to supply chain failures. You can dig into the full report and its implications on the Everbridge website.

This data really hammers home one simple truth: you can’t afford to wait for a crisis to hit before you have a plan. Building resilience means you’re actively working to ensure:

- Operational Stability: Your essential work gets done, even when things outside your walls are chaotic.

- Financial Security: You protect your revenue and have the strength to ride out economic downturns.

- Team Confidence: Your people know there’s a plan, which cuts down on panic and keeps everyone focused.

- Customer Trust: You keep your promises, which is the bedrock of a great brand reputation.

Ultimately, investing in resilience transforms your company from something that could easily break into something built to last, ready for today’s problems and tomorrow’s opportunities.

Finding Your Business’s Achilles’ Heel

Every business has a weak spot. The real trick is finding it before a crisis does. This part of building your resilience plan is all about figuring out what your business absolutely cannot function without. Some people call this a “Business Impact Analysis,” but I just call it finding your Achilles’ heel.

Let’s get practical. What operations, if they went down for just one day, would seriously hurt your bank account or your reputation? We’re not just talking about IT here. It’s about your people, your core processes, and even your key suppliers. The goal is to get past those vague, late-night worries and build a clear, prioritized list of what you need to protect first.

Pinpointing Your Critical Operations

First things first, you need to identify the absolute core functions that keep the lights on and the money coming in. This means mapping out every activity that’s truly essential.

Start by grabbing a notepad and asking yourself a few pointed questions:

- Where does our money really come from? Is it the e-commerce checkout? The client invoicing system? That one flagship service?

- What promises have we made? Think about contractual obligations. Missing a big client deadline can have nasty ripple effects.

- What keeps our customers happy? Maybe it’s your lightning-fast customer support line or your seamless order fulfillment process.

- What do we have to do legally? Don’t forget any activities required for regulatory compliance.

Let’s say you run a small catering business. Your critical operations might be your online booking system, your relationship with your main food supplier, the walk-in fridge, and the two chefs who hold all the secret recipes. If any one of those fails, you’re dead in the water.

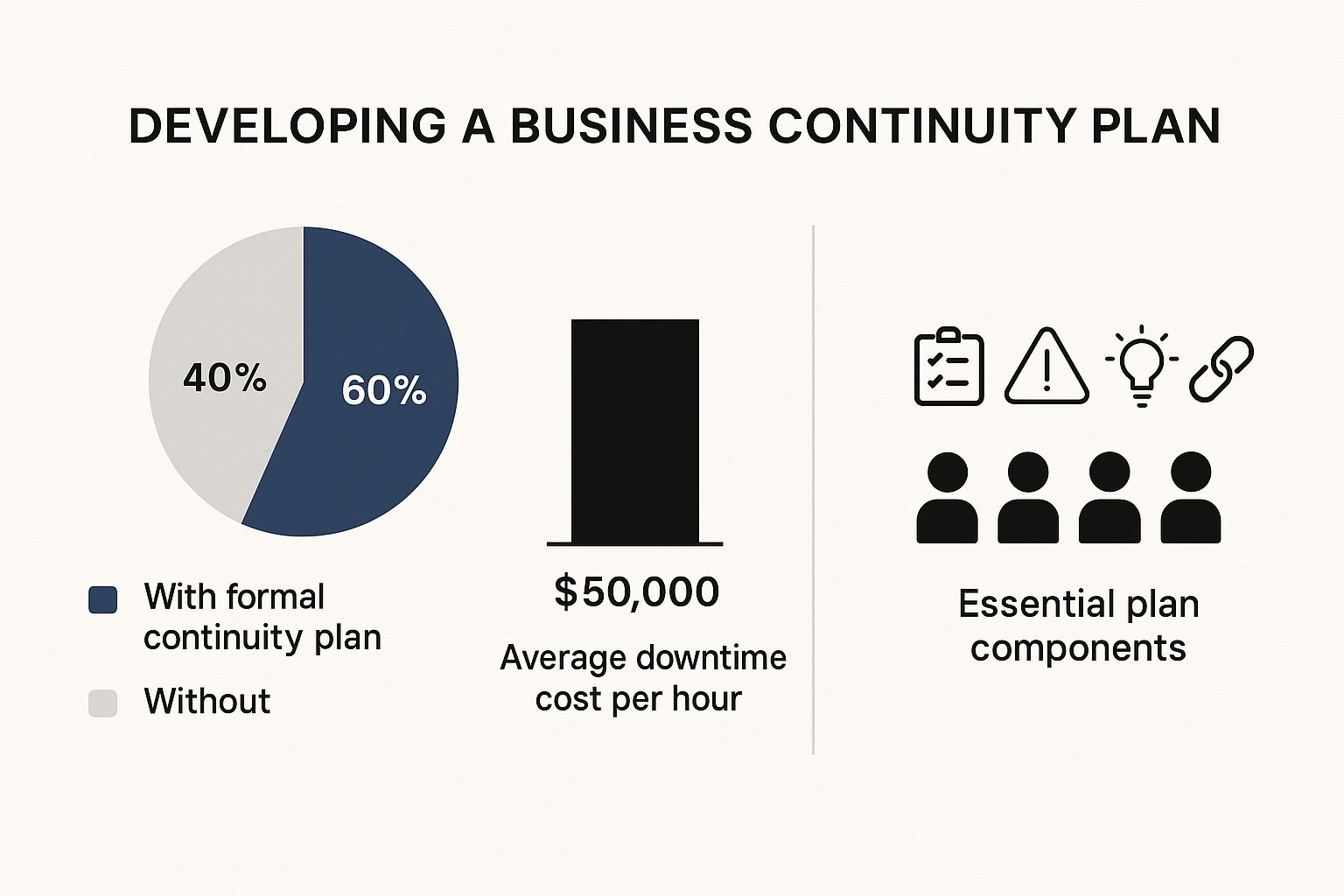

This is why getting proactive is so critical for businesses of all sizes.

The data here tells a stark story. Most businesses are flying without a plan, and the cost of being knocked offline—even for a short time—is staggering. Resilience isn’t just a buzzword; it’s a financial necessity.

Mapping Out Realistic Threats

Once you know what’s most important, it’s time to brainstorm all the ways things could go sideways. This isn’t about doomsday prepping. It’s a realistic look at the kinds of risks that are actually out there. Think broadly.

Threats can pop up from anywhere:

- Operational: Your main delivery van finally gives up the ghost. A critical piece of equipment fails. Your go-to supplier suddenly shuts down.

- Financial: A major client ghosts you on a huge invoice, creating a cash flow crisis. A sudden recession hits your industry hard.

- Technological: A ransomware attack encrypts all your files. Your website crashes on Black Friday. A critical software subscription lapses.

- Human: Your star employee with all the institutional knowledge quits without notice. Your whole team gets hit with the flu at the same time.

- Environmental: A local flood makes your office inaccessible. A nasty storm knocks out the power for three days.

Understanding these pitfalls is key. It’s worth reading up on some of the common mistakes that can undermine small businesses during an economic downturn to get a sense of just how real these financial and operational risks are.

Prioritizing Your Risks

Okay, you’ve got your list of potential disasters. Now what? The reality is, you can’t fix everything at once. You need to sort these risks by how likely they are to happen and how much damage they’d cause if they did. This is how you focus your precious time and money where it matters most.

This is where a simple risk assessment matrix comes in handy. It’s a fantastic tool for turning a long list of worries into an organized action plan.

My Pro Tip: Don’t do this alone in a dark room. Get your team involved! Your front-line staff often have a much clearer, ground-level view of daily operational risks. They’ll point out vulnerabilities you never would have thought of.

A matrix helps you visualize everything and assign a priority level to each threat.

Risk Assessment Matrix for Small Businesses

Here’s a simple matrix to help you categorize potential business risks by their likelihood of occurring and their potential impact on your operations. Just fill in the blanks for your own business.

| Risk Category (e.g., Financial, Operational, Cyber) | Specific Risk Example | Likelihood (Low, Medium, High) | Impact (Low, Medium, High) | Priority Level |

|---|---|---|---|---|

| Operational | Main food supplier goes out of business | Medium | High | High |

| Technological | Ransomware attack on office computers | Low | High | Medium |

| Human | Head chef quits without notice | Medium | Medium | Medium |

| Financial | Major corporate client defaults on a large invoice | Low | Medium | Low |

By rating each risk this way, you’ll immediately see what needs your attention right now. A high-likelihood, high-impact event (like your only payment processor going offline) should be at the very top of your list.

This process transforms those abstract fears into a concrete guide. You now know exactly where your business is most exposed, which is the foundational first step to building a resilience plan that actually works when you need it.

Crafting Your Actionable Resilience Plan

Okay, you’ve pinpointed your biggest risks. Now it’s time to roll up your sleeves and build a plan your team can actually use when things get messy. A plan that just sits on a shelf collecting dust is completely worthless in a real crisis.

Forget about creating some hundred-page binder filled with corporate jargon. What you need is a practical, living document that acts as a genuine lifeline when you need it most.

This is where all that risk assessment work starts to pay off. Those “high priority” items you identified? They’re your starting point. For each one, you’re going to map out a simple, clear response strategy. Remember, we’re aiming for progress here, not perfection.

Building Your Core Response Strategies

Think of these as mini-playbooks for your biggest threats. For every single high-priority risk, you need to outline the immediate actions, who’s responsible for them, and what they’ll need to get the job done.

Let’s jump back to our catering business example. Their top operational risk was their main food supplier suddenly going out of business.

Their mini-plan for that specific scenario might look something like this:

- Immediate Action: The head chef’s first move is to call the two pre-vetted backup suppliers to check on their inventory and current pricing.

- Responsibility: The head chef owns this task. The business owner is the secondary contact if the chef is unreachable.

- Resources Needed: A shared digital list with contact info for backup suppliers, including after-hours numbers and any relevant account details.

See? It’s not rocket science. But it completely removes the guesswork and panic from the situation. It’s a simple, clear instruction set ready to go.

The Non-Negotiable Elements of Your Plan

Every solid business resilience plan, no matter the industry, needs a few core components to actually work. Think of these as the foundation supporting all your specific response strategies.

1. A Simple Communication Tree

When a disruption hits, confusion is your worst enemy. You need a crystal-clear system for who calls whom—both inside your team and with key clients or partners outside the business. It should spell out:

- Who is the main point person to lead during a crisis.

- The exact order team members should be contacted.

- Backup communication methods if your primary channels (like email or Slack) are down.

2. A Vetted List of Backup Suppliers

Don’t wait for your go-to supplier to disappear before you start scrambling for alternatives. You need to identify and vet backup providers for your most critical resources right now. This could be for anything from raw materials and inventory to specialized software or even freelance talent.

3. Data Backup and Recovery Protocol

Let’s be real—losing your data can be a business-ending event. Your plan must include an affordable and reliable system for backing up all critical information (customer lists, financial records, project files) and a clear, tested process for restoring it fast.

I once worked with a small graphic design firm whose server got slammed with ransomware. They were back online in under a day. Why? Because they had a robust, off-site backup system and a clear recovery plan they’d actually practiced. Their competitor, hit by the same attack, had no plan. They were down for over a week and lost two major clients in the chaos.

This kind of proactive work pays huge dividends. In fact, research shows that enterprises with well-developed resilience frameworks are 2.5 times more likely to recover quickly from crises and keep things running.

Financial Preparedness and Cash Flow

A crucial, yet surprisingly overlooked, part of business resilience planning is your financial health. A crisis can put an immense strain on your finances, and having a cash buffer is absolutely essential.

Your plan needs to detail how you’ll manage money during a disruption. This means identifying non-essential expenses you can hit pause on and making sure you have access to emergency funds or a line of credit. As you build out your plan, getting your financial house in order is paramount. You can learn some vital strategies by checking out How to Improve Cash Flow.

This financial foresight is what stops a temporary operational headache from spiraling into a full-blown financial catastrophe. Your ability to pay your team and your key suppliers is what will keep the lights on while you navigate the storm. The real strength of your plan lies in its practicality and the confidence it gives your team to act decisively when it matters most.

Learn more:

Strategies to Increase Your Cashflow Effectively

Cash Flow Reality: Why Your Profit Doesnt Match Your Bank Balance

Weaving Resilience into Your Daily Work

A business resilience plan gathering dust on a shelf is worse than useless—it’s a waste of good intention. For a plan to have any real teeth, it can’t just be a document you write and forget. It needs to become part of your company’s DNA, woven directly into how you operate every single day.

This is the part so many businesses get wrong. They treat resilience as an IT problem or a one-off project for the leadership team. But genuine resilience is a mindset. It should subtly influence every decision your company makes, from who you hire and how you train them to the way you manage your finances.

Turning Your Plan into Daily Practice

The goal here is to shift your thinking from creating a “plan” to building a “culture” of resilience. It all starts with small, consistent actions that make preparedness and quick thinking second nature for your team.

A simple way to start is by baking these conversations into your regular meetings. Kicking off a new project? Try asking, “Alright, what are the top three things that could completely derail this, and what’s our immediate plan B for each?” That one question forces everyone to think ahead and gets proactive problem-solving on the agenda.

When you do this, business resilience planning stops being a static document and becomes an active, ongoing conversation. You’re building the muscle memory your team needs to react without scrambling for a binder when things go sideways.

Tracking What Truly Matters: Resilience KPIs

You track sales, you track marketing metrics—are you tracking your ability to bounce back? If you can’t measure it, you can’t improve it. Introducing a few key performance indicators (KPIs) can turn vague goals like “be more resilient” into concrete, actionable targets.

Sadly, this is where most companies are still playing catch-up. A 2025 report from the World Economic Forum, based on a survey of over 250 global business leaders, revealed that only 13% of companies fully bake resilience KPIs into their strategic plans. You can dig into the findings yourself in the WEF Resilience Pulse Check 2025 report.

Here are a few practical metrics you can start tracking:

- Recovery Time Objective (RTO): How fast can you get a critical system back online after it goes down? Set a goal, say under one hour, and measure how you do during tests.

- Team Readiness Scores: After a practice drill, send out a quick survey. On a scale of 1-5, how confident do people feel about their role in a crisis? Low scores are a clear sign you need more training in specific areas.

- Backup Verification Rate: What percentage of your data backups are actually tested and confirmed to work each month? You should be aiming for 100%. Anything less is a gamble.

“Resilience isn’t just about having backups; it’s about the confidence that those backups will actually work when you need them. Testing and measuring are what turn a hopeful plan into a reliable one.”

These KPIs don’t need to be overly complex. They just need to give you an honest snapshot of your readiness, helping you find the weak spots before they become full-blown disasters.

Making Resilience Training Stick

Let’s be real—nobody looks forward to mandatory, mind-numbingly boring training sessions. If you want your team to actually get on board, you have to make resilience training relevant to their jobs and, dare I say, maybe even a little engaging. The trick is to ditch the abstract lectures and get hands-on with scenario-based exercises.

Instead of a generic PowerPoint on cybersecurity, try running a quick, practical drill.

For example, a Phishing Email Drill:

- The Setup: Use a safe tool to send a simulated phishing email to your team.

- The Action: See who reports it correctly versus who clicks the dangerous link.

- The Follow-Up: This is the important part. Don’t shame the clickers! Use it as a real-time teaching moment. A quick, 5-minute refresher on spotting red flags right after they’ve experienced it makes the lesson immediate, practical, and much more likely to stick.

This kind of hands-on practice is worlds more effective than a long-winded slideshow. It transforms the theoretical danger of a “phishing attack” into a tangible experience. By weaving these small, consistent practices into your daily work, you turn resilience from a chore into a shared strength—a core part of how you do business.

How to Stress-Test Your Resilience Plan

You’d never buy a boat without first checking it for leaks, right? So why would you bet your business on a resilience plan you’ve never actually put through its paces? A plan sitting in a folder is just a good intention. A tested plan, on the other hand, is a tool you can genuinely rely on.

Stress-testing is how you find the cracks in your strategy before a real crisis hits. It’s about building the “muscle memory” your team needs to act decisively, not panic, when things go sideways. And the good news? You don’t have to orchestrate a full-blown catastrophe to do it. The idea is to test your plan in practical, manageable ways that turn theory into real confidence.

The Power of “What-If” Scenarios

One of the easiest yet most powerful ways to get started is with a tabletop exercise. Don’t let the name intimidate you. It’s really just a guided chat where you and your team walk through a potential crisis. It’s low-stress, requires zero tech, and you can knock it out in an afternoon.

Picture this: you get your key people in a room and pose a simple problem. “Okay team, our main payment processor just went down. They’re telling us it’ll be offline for 48 hours. What’s our first move?”

You’ll quickly see who knows their role, whether your communication methods actually work, and if that “critical” data is truly accessible. This is where you uncover all the hidden assumptions that look perfectly fine on paper but crumble under the slightest pressure.

I’ve seen this happen time and again. A business thinks their communication plan is solid, but during a test, they realize the emergency contact list is saved on the very server that would be down in that scenario. A simple tabletop exercise uncovers that in minutes.

These sessions aren’t about pointing fingers; they’re about finding fixes. The insights you can pull from a single one-hour discussion are gold for strengthening your business resilience planning.

Hands-On Functional Drills

Once you’ve got a few tabletop exercises under your belt, you can graduate to functional drills. These are more hands-on tests that focus on a single piece of your plan to see if it actually works. You aren’t simulating the whole disaster, just one critical response function.

Here are a few practical ideas you can try:

- Data Recovery Test: Do your backups actually work? Don’t just trust the green checkmark. Try restoring a non-essential file you “accidentally” deleted. The result might just surprise you.

- Supplier Contact Drill: Ask someone to call your backup supplier—the one you’d rely on in a pinch. Can they confirm they have the stock you’d need? Is the contact number you have for them even correct anymore?

- Work-from-Home Simulation: Without any warning, ask a few team members to work from home for the day. Can they access every system, file, and tool they need to be productive?

These mini-tests are targeted, easy to manage, and give you hard evidence of what’s working and what’s broken.

Capturing Lessons and Improving Your Plan

A test is only useful if you actually learn from it. After every drill—no matter how small—you need to sit down and capture what went right and what went wrong. This doesn’t need to be some stuffy, formal report. A simple shared document is perfect.

A basic checklist can help guide your review:

| Testing Checklist Item | Pass/Fail | Notes and Action Items |

|---|---|---|

| Communication: Was the right person notified first? | Pass | Contact info was up-to-date. |

| Data Access: Was critical data accessible? | Fail | Key spreadsheet was on a local drive, not the cloud. |

| Backup System: Could the backup supplier be reached? | Pass | Contact was successful, confirmed stock levels. |

| Decision-Making: Was it clear who made the final call? | Fail | Confusion between owner and manager on who authorizes spending. |

Analyzing the results like this turns those “Fails” into a clear to-do list. Maybe you need to move that key file to the cloud or spell out who has the authority to make spending decisions in the plan itself.

If you’re starting from scratch or feel your current plan has gaps, using a solid foundation can make all the difference. You can get a huge head start by checking out this helpful business continuity plan template to make sure you’re covering all your bases from the get-go. Each test, each tweak, makes your plan stronger, turning it into a living document that grows right alongside your business.

Got Questions About Business Resilience? We’ve Got Answers

Let’s dive into some of the questions I hear all the time from small business owners when they start thinking about a business resilience plan. These are the practical, real-world answers you need to get this done right.

I’m a Tiny Business. Do I Really Need to Bother With This?

Yes, you do. And honestly, you probably need it more than the big corporations. As a small business, you’re more exposed. You likely don’t have the huge cash reserves or spare resources to fall back on when something goes wrong. A single disaster—a flood, a key supplier going bust, a cyber attack—can be a knockout blow.

Don’t let the word “plan” intimidate you. We’re not talking about a 100-page binder full of corporate jargon. For a small operation, it could be a simple, practical checklist.

Think of it as a guide that lists your top five biggest risks, your key emergency contacts, and the first three things you’ll do for each scenario. It’s an insurance policy you hope you never cash in, but you’ll be profoundly glad you have it if you ever need to. This isn’t about creating busy work; it’s about having a fighting chance to stay open.

How Often Should I Dust Off and Update This Plan?

Things change, and so should your plan. A good rhythm is to give your plan a full, top-to-bottom review at least once a year. Pop a recurring reminder in your calendar right now so it doesn’t get forgotten.

But you should also pull it out and give it a quick refresh anytime there’s a major shift in your business. For instance:

- You move to a new office or workshop.

- A key team member with unique skills leaves (or you hire one).

- You switch to a critical new piece of software or change a primary supplier.

- You launch a major new product or service that changes your operations.

The business world doesn’t stand still, and a stale plan is a useless one. Those quick tweaks, combined with a dedicated annual review, will ensure your plan is actually ready to go when you need it.

The single biggest mistake I see is when a business owner creates a plan, shoves it in a drawer, and forgets it exists. It quickly becomes a relic, full of old phone numbers and outdated steps. An old plan is just as dangerous as having no plan at all.

Keeping it current is what separates a truly resilient business from one that just ticked a box on a to-do list.

What’s the Biggest Mistake People Make With This?

Besides letting the plan gather dust, the next biggest blunder is doing it all yourself. Resilience is a team effort. If you’re the only person who knows what the plan is, you’ve just made yourself the weakest link.

What happens if you’re on holiday, sick, or simply unreachable when a crisis hits?

Get your team involved from the very beginning. They’re on the front lines and will see potential problems you’d never spot from your desk. When people help build the strategy, they feel a sense of ownership. They’ll know their role and can act confidently instead of panicking. Your team is your greatest asset in an emergency—empower them to be part of the solution.

Figuring out all the ins and outs of business resilience planning can feel like a heavy lift, but you don’t have to tackle it alone. The team at Business Like NZ Ltd specializes in the kind of business advisory services that help small and medium businesses in Auckland build stronger, more secure futures. Let’s work together to create financial freedom for you. Start building your resilience today.